Case Studies

Secured International Trademark Registrations for a Multispecialty Healthcare Group

We enabled a leading multispecialty healthcare group to secure international trademark registrations, protecting their brand identity across borders with seamless legal and strategic support.

Delivered LLP Compliance Support for a Multinational Client in India

We enabled a multinational data services enterprise to achieve complete LLP compliance in India through structured regulatory governance and robust compliance management.

Helped a Global Client Establish Its Subsidiary in India

We enabled a global client to enter India confidently by establishing its subsidiary with complete compliance and operational readiness.

SME Listing Strategy & Structuring Support for a Digital Health Platform

Hedge-Square supported the client in the SME listing process by offering complete advisory on readiness, regulatory compliance, corporate structuring, and strategic preparation for capital market access.

Fundraising Advisory & Structuring Support for a Pharmaceutical Client

We partnered with a pharmaceutical client to structure financial strategies, enabling capital infusion for expansion and compliance. Our end-to-end advisory ensured investor readiness and successful funding alignment.

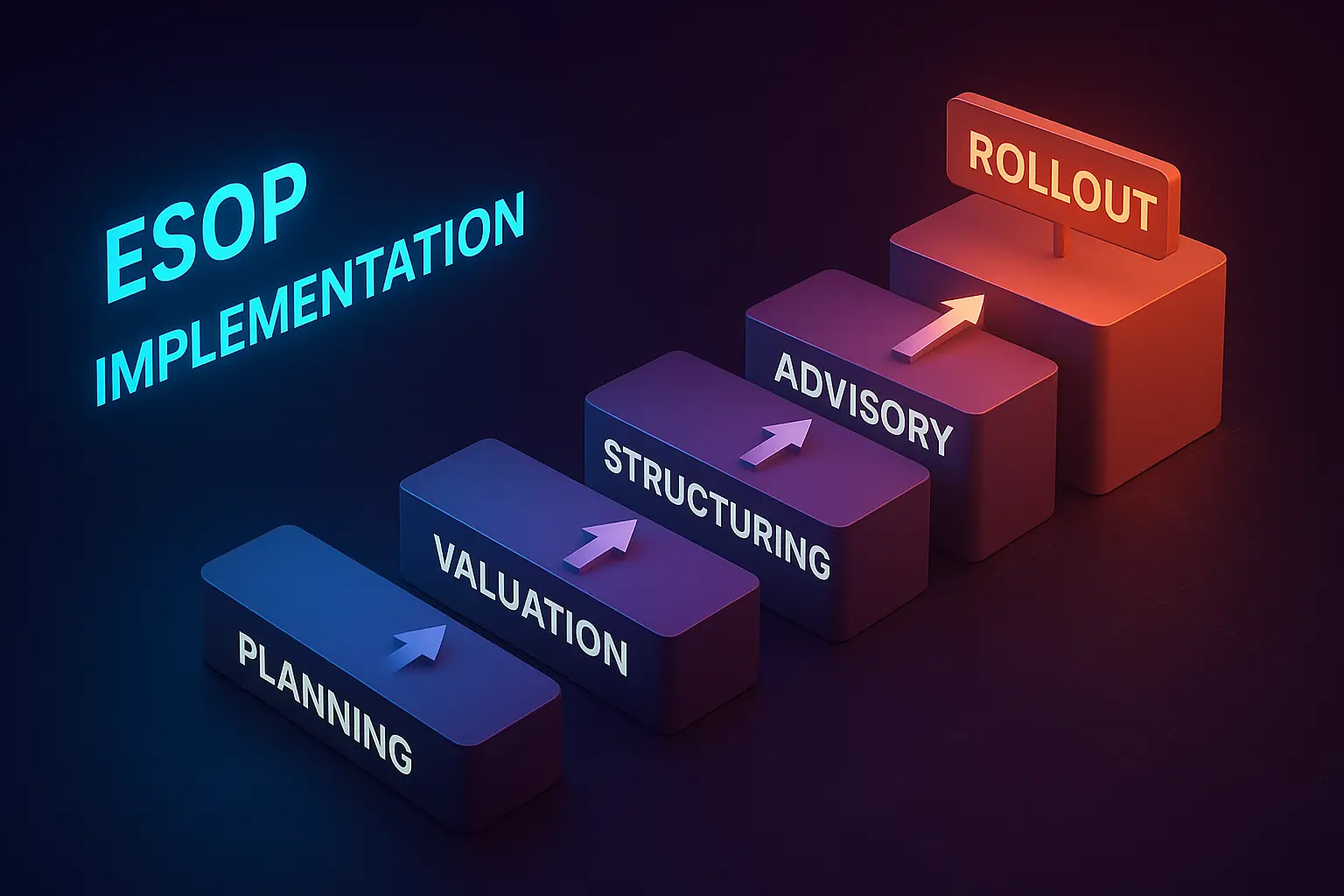

Structuring and Advisory Services for ESOP Implementation

We help organizations navigate complex financial structures. Recently, we successfully tailored an ESOP for a client, aligning it seamlessly with their team structure and long-term strategic goals.

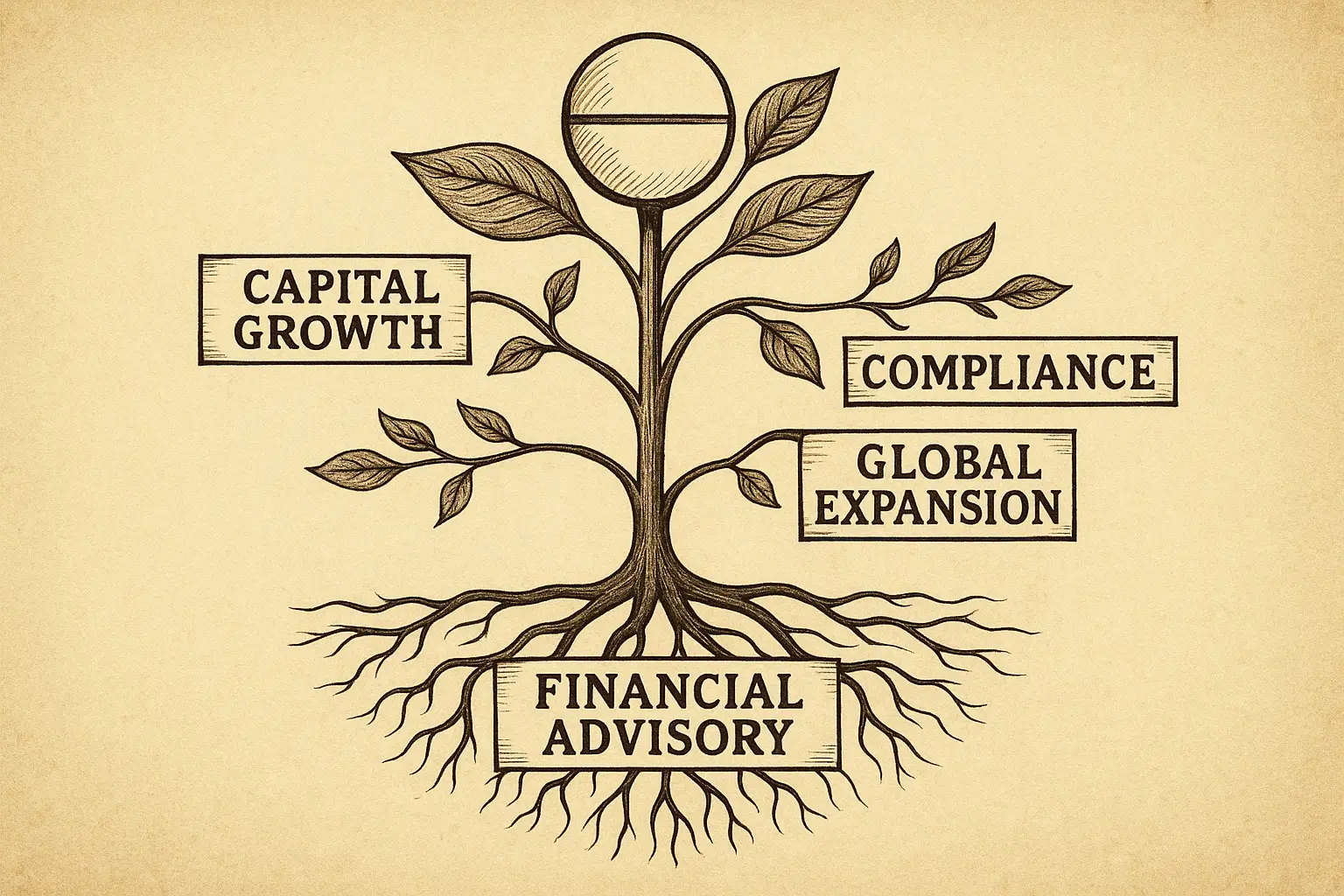

Facilitating Seamless Global Expansion

In today’s globalized economy, businesses are increasingly exploring international markets to access new growth opportunities.